2025 NZ Mortgage Interest Rates: What It Means for Homeowners

- VIKON | Design & Construction

- Jul 11, 2025

- 3 min read

We’ve all experienced the post-pandemic rise in New Zealand’s OCR and the ripples it has had across every sector of the New Zealand economy, particularly when it comes to housing, employment and groceries.

Lowered Rates

Over the past year, the Reserve Bank of New Zealand has been slowly easing off the brakes. After sitting at 5.5% for over a year between 2023 and 2024, the OCR was reduced to 3.25%, and as of the latest update on 9 July 2025, it remains unchanged.

The Reserve Bank said these cuts were partly in response to rising global tariffs and growing economic uncertainty. By lowering the OCR, they’ve aimed to soften the impact on households and businesses here in New Zealand, bringing down both interest and mortgage rates in the process.

Why Does Lowered OCR Matter?

Lowered OCR have a direct impact on mortgage interest rates. When the OCR goes down, banks usually follow by lowering the interest rates they charge on home loans. This typically means lower monthly repayments for both current homeowners and those looking to buy.

For current homeowners, this reduction eases financial pressure by making mortgage payments more manageable. It can free up funds for other priorities, like home improvements or savings. For prospective buyers, lower interest rates increase borrowing power, making it easier to enter the property market or move into a new home.

Impact on Homeowners: Changing patterns

We’re already seeing signs that people are responding. In a recent interview with 1News, local economist Brad Olsen pointed out how homeowners are changing their approach to interest rates.

Back in January and February 2025, most households were leaning towards floating or short-term rates, likely due to uncertainty or dissatisfaction with what was available at the time. But by March and April, things had shifted 61% of new lending went to 1–2 year fixed terms, which suggests people are feeling more confident and willing to commit. That change also means more homeowners have extra breathing room in their budgets.

It’s a small but promising step toward getting New Zealand’s housing market moving again, especially at a time when buyer activity has been sluggish.

Fixed vs Floating Mortgage Rates NZ

Interest rates are still high, so even as they begin to ease, choosing between a fixed or floating mortgage is no simple decision.

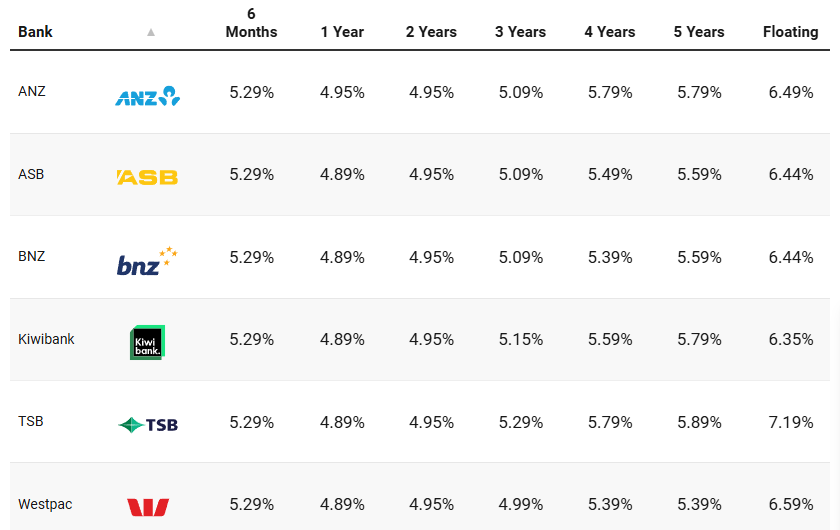

As of Friday 4 July 2025, the average 1-year fixed rate was 5.02%, while the average floating rate sat higher at 6.35%, a difference of 1.33%. Both are relatively high, but each option comes with trade-offs:

The 1-year fixed rate is more stable. You know exactly what your repayments will be for the next 12 months. But if rates drop during that time, you won’t benefit from it.

The floating rate offers flexibility. You’ll pay more upfront, but if rates fall, you’re in a position to take advantage of them. It’s especially useful for those who plan to make extra repayments and want to avoid early repayment fees.

Most financial advisers recommend a mix. Peter Norris, mortgage broker and Managing Director at Opes Mortgages, suggests fixing the majority of your mortgage to lock in some certainty, while keeping a smaller portion around 5–10% on floating. This gives you the flexibility to make extra repayments or reduce debt faster without incurring early repayment fees..

A Quick Rule of Thumb

If you believe interest rates will go up, you’re more likely to fix for longer. You might pay a little more in interest today, but you protect yourself from future increases.

If you think interest rates are about to fall, you may want to keep things short or stay on floating. That way, you’re not locked into a high rate while the market shifts downward.

So, Why Does This Matter to You?

No home is perfect as is; with the pressure of mortgage payments easing off, many homeowners now have more financial flexibility to invest back into their living spaces. Whether you’re thinking about renovating your existing home, be it a kitchen upgrade, bathroom makeover, or adding smart storage solutions, or planning a brand-new build, this is a great time to bring those projects to life.

At VIKON, we’re here to support you every step of the way. From architectural design and construction through to interior design and renovations, our experienced team works closely with you to create spaces that reflect your lifestyle and dreams.

With lower financial burdens, now’s the moment to transform your home or create a new one tailored perfectly to you.

📢 Original source: Mortgage rates: How low could they go?, Current NZ mortgage interest rates and 6 things to consider, https://www.rnz.co.nz/news/political/566419/reserve-bank-holds-official-cash-rate-at-3-point-25-percent

Comments